Contents

- Competition Commission of India (CCI) is looking to hire more people in the areas of law, economics and financial analysis.

- French Envoy Lauds India’s Entry Into Top 50 Global Innovation Index

- Top review from India

- Tata Group plans to merge all its airline brands in to Air India

- How to use Commodity Channel Index Divergence Indicator?

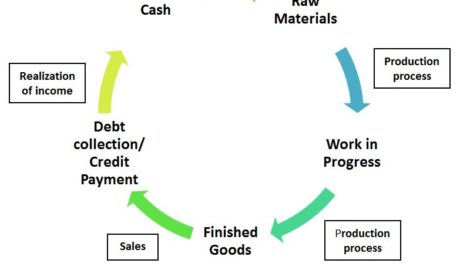

Commodity Channel Index is a versatile indicator that can be used to identify a new trend or warn of extreme conditions. Lambert originally developed CCI to identify cyclical turns in commodities, but the What Caused the Stock Market Crash of 1987 indicator can successfully be applied to indices, ETFs, stocks, and other securities. In general, CCI measures the current price level relative to an average price level over a given period of time.

One should enter the stock when this indicator cross 100, as it which indicates a buy signal and exit the stock when this indicator cross -100, as it which indicates a sell signal. Price Data sourced from NSE feed, price updates are near real-time, unless indicated. Technical/Fundamental Analysis Charts & Tools provided for research purpose. Please be aware of the risk’s involved in trading & seek independent advice, if necessary. A digital platform for discussions, communication, and policy-making on the development of women.

Competition Commission of India (CCI) is looking to hire more people in the areas of law, economics and financial analysis.

The most widely used method for interpreting the RSI is price/RSI divergence, support/resistance levels, and RSI chart formations. The Accumulative Swing Index is a cumulative total of the Swing Index. The Accumulative SwingIndex may be analyzed using technical indicators, line studies, and chart patterns, as an alternative viewof price action. The Ease of Movement oscillator shows a unique relationship between price change and volume.

A Typical Price is often used as an alternative way of viewing price action, and also as a component for calculating other indicators. Developed by Marc Chaikin, Chaikin Money Flow measures the amount of Money Flow Volume over a specific period. Money Flow Volume forms the basis for the Accumulation Distribution Line. Instead of a cumulative total of Money Flow Volume, Chaikin Money Flow simply sums Money Flow Volume for a specific look-back period, typically 20 or 21 days.

Indicator oscillates around the naught line tending to stay within the range from -100 to +100. The naught line represents the level of an average balanced price. The higher the indicator surges above the naught line the more overvalued the security is.

French Envoy Lauds India’s Entry Into Top 50 Global Innovation Index

The Keltner Channel is a moving average band indicator whose upper and lower bands adapt to changes in volatility by using the average true range. The Keltner Channel is used to signal price breakouts, show trends, and give overbought and oversold readings. Over that, recursive smoothing is applied to the original MA to create nine additional moving averages, each being based on the previous MA. Through a process of repetitive smoothing, the result obtained is a full spectrum of trends, which plotted on a chart with continuous colors, have the appearance of a rainbow. The Rainbow Oscillator Indicator is, like the Rainbow Charts, an indicator used to follow trends and its graph is plotted based on the same calculations made to find the Rainbow Charts. The practice of drawing trend lines on a stock chart is almost as old as buying stock itself, but one can also draw trend lines on the indicators.

While any move to -100 suggests weakness and beginning of a downtrend. The trend line break of the CCI is also keenly observed by the traders. Elearnmarkets is a complete financial market portal where the market experts have taken the onus to spread financial education. ELM constantly experiments with new education methodologies and technologies to make financial education effective, affordable and accessible to all. However, unlike other oscillators, one should use CCI in conjunction with price or other indicators rather than looking on a standalone basis. The very fact that CCI has been used by the traders so long signals its importance in the trader’s community.

The indicator was designed for use on a monthly time scale and is calculated as a 10-month weighted moving average of the sum of the 14-month rate of change and the 11-month rate of change for the index. Moving Average Envelopes consist of moving averages calculated from the underlying price, shifted up and down by a fixed percentage. Moving Average Envelopes can be imposed over an actual price or another indicator.

Top review from India

The metrics that ‘statistically turn price and volume data’ are likely to lag behind the price itself and expected to give ample previous data, enclosed already in it. Confirmation is an essential indicator providing a clear insight into the divergences. However, divergences represent a shift in direction that is likely to trigger a trend reversal. Although, a strong uptrend sometimes reveals various bearish divergences before the top eventually pops up.

What is CCI Buy Signal?

What is CCI Indicator buy signal? One should that CCI mainly moves between the range of -100 and 100. One should enter the stock when this indicator cross 100, as it which indicates a buy signal and exit the stock when this indicator cross -100, as it which indicates a sell signal.

The premise is that well-informed investors are buying when the index rises and uninformed investors are buying when the index falls. High Low Bands consist of triangular moving averages calculated from the underlying price, shifted up and down by a fixed percentage, and include a median value. Bollinger Bands are similar in comparison to moving average envelopes.

Tata Group plans to merge all its airline brands in to Air India

The Commission is tasked with the job of eliminating anti-competitive practices, protecting the interest of consumers and ensuring free trade. As per the GST law, a 3-tier structure was set up for investigation and adjudication of the profiteering complaints. As per the decision by the Council, NAA will cease to exist from December 1. Henceforth, all investigations, based on complaints filed by consumers, will be done by the Directorate General of Anti-profiteering which will then submit a report to CCI. To hike the remuneration levels for such people, the Commission last month amended the Competition Commission of India Regulations. The regulator has now called for applications to engage four experts/professionals in different areas.

- The oscillator is above the zero points if the forecast price is higher than the current price.

- On the flip side, there are also bullish divergences in the long downtrends.

- The Triangular Moving Average is similar to a Simple Moving Average, except that more weight is given to the price in the middle of the moving average periods.

- Similarly, the next time whenever they want to see how big the trend pattern is, they will glance at CCI for a suggestion.

- When the indicator is rising, the security is said to be accumulating.

The Commodity Channel Index values will be at its peak when the prices exceed the average level, and this signal will be pointing strength. This CCI chart indicates the possibilities of overbought and oversold conditions and provides valuable insight to the trader to find a buy or sell opportunity. Let’s understand how a trader should https://1investing.in/ use CCI to get a glimpse of potential buy and sell signals. Thus, CCI is an effective way for traders to create a clear pattern of overbought and oversold phases in the market. One can use multiple ways to cover short sell trades, like when CCI re-enters the oversold zone or price trend line break out or CCI trend line break out.

How to use Commodity Channel Index Divergence Indicator?

To examine these patterns the Fractal Chaos Oscillator can be used to determine what is happening in the current level of resolution. Fractal Chaos Oscillator is a great indicator to use in intra-day trading. The On Balance Volume indicator shows a relationship between price and volume as a momentum index. On Balance Volume index generally precedes actual price movements.

Which is better CCI or RSI?

Generally speaking, the RSI is considered a more reliable tool than the CCI for most markets, and many traders prefer its relative simplicity.

As a leading indicator, one can look for the overbought or oversold zone which may indicate trend reversals. One can also look for bullish or bearish divergences for trend reversals. The National Anti-profiteering Authority was established under section 171 of the Central Goods and Services Tax Act, 2017. The NAA was set up to monitor and to oversee whether the reduction or benefit of input tax credit is reaching the recipient by way of appropriate reduction in prices.

This oscillator produces almost zero lag indicating the pivot points with precise accuracy. The Trade Volume Index shows whether a security is being accumulated or distribute (similar to theAccumulation/Distribution index). But make sure that, like other indicators, CCI also has few underlying risks, so you need to consider every point carefully. While most of the traits of Commodity Channel Index Indicator are somewhat similar if we compared with other oscillators. So, this was all about the CCI Indicator, how this powerful tool helps traders despite a few shortcomings.

The further the CCI indicator plunges into the negative area the more potential for growth the price may have. Still the unbalanced price alone may not serve as a clear indicator neither to the direction the price is following nor to its strength. The Gopalakrishnan Range Index by JayanthiGopalakrishnan quantifies the variability in stock, based on the logarithm of the trading range over an N-day period .